Now-a-days, Insurance is a must-have factor for everyone. It protects against the risk of indeterminate terms. Insurance is to help everyone if a person can’t afford to pay out of the pocket to set right the things, which are gone wrong.

Happenings such as medical expenses of a operation or of a serious illness, vehicle damage, a tree in one’s yard falling on a neighbour’s house, unwanted circumstances in travelling etc.

Whether it is related to life, health, travel or vehicle, insurance is needed in almost everything perspective. Assess the life of a person and needs, he/she can decide the type of insurance is needed to protect from risks. Here is a list of type of insurance that may need to consider:

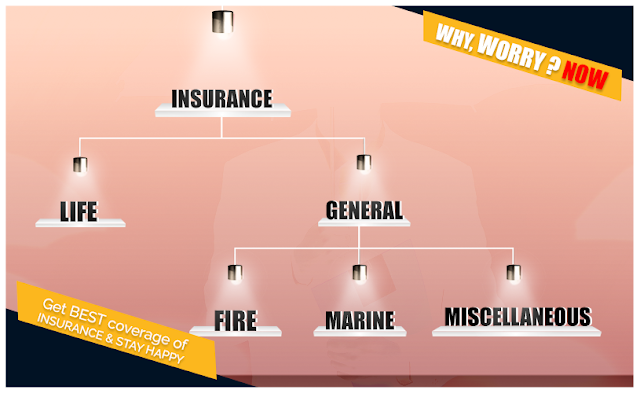

Insurance is generally categorized into Life Insurance and General Insurance.

1) Life Insurance

Life Insurance provides the coverage of lives of human beings. In a family, lives of all the family members depend on person’s earning. Earning and his/her life are an income generating assets. These assets can be lost through unexpected happenings, illnesses, disabilities caused by accidents, early death, or living too long without any income source and many.

For example:

A person based on the life expectancy (for example, approximately 80 years), made financial arrangements and savings to live comfortably till lifetime. But if the person lives to long (in this case beyond 80 years), then he/she will run out of financial resources and will face life’s difficult phase.

Life insurance will safeguard the person in such risks of longevity in the form of pension plan.

2) General Insurance

General Insurance (or non-life insurance) covers non-living objects such as vehicle, goods, agricultural crops, medical, travel etc. This insurance also covers losses/damages incurred through unwanted circumstances such as fraud, earthquakes, accidents etc.

Mostly, non-life insurance is for one year and is renewable with additional benefits (such as (NCB) No Claim Bonus).

General Insurance is divided into three categories:

• Fire Insurance

• Marine Insurance

• Miscellaneous (Health Insurance, Travel Insurance, Liability Insurance, Motor Insurance, Personal Accident, Burglary, Fidelity etc.)

a) Fire Insurance

This insurance deals with all fire related risks and covers damages or losses incurred due to earthquakes, malicious acts, cyclones, riots typhoons and consequential expenditure related to these disasters.

b) Marine Insurance

This insurance covers the risks of transporting goods via rail, road, sea, air and marine.

c) Miscellaneous Insurance

Apart from these insurance, person can opt for Health Insurance, Travel Insurance etc. mentioned above.

Apart from these insurance, person can opt for Health Insurance, Travel Insurance etc. mentioned above.

One should make sure that accidents and illness to human beings are covered under Health insurance in India, while it is covered under Life Insurance in many countries.

No comments:

Post a Comment